Dear Reader,

There may never have been a surer sign for bullishness in lithium stocks than this.

Last November, the benchmark by which other supercar makers are judged, Ferrari, announced an all electric model by 2025.

It is the oldest, the best known, the most revered, and when it comes to resale price and collectability, by far the most valued brand of race-bred street car in existence.

For those unfamiliar with the performance automobile culture, let me add a bit of perspective to illustrate how significant this is.

In Ferrari’s 85 year history, the company only put out 6 turbo-charged street car models — the first of which appeared in 1981 on the heals of the OPEC-driven gas-crisis.

That might sound like a ‘so what’ piece of data, but over the years, Ferrari has produced no fewer than 110 models, of 48 distinct types built for street driving.

So out of 110 chances, the company only chose to install forced induction into their engines 6 times over the years, despite nearly all of their competitors offering turbo-charged production models every year since the late 1970s.

The reason is simple: Ferrari’s very reason to exist lies in the power, the performance, and the sound that can only be derived from a naturally aspirated V8 or V12.

The Italians simply refer to it as passion.

Lithium… Not Oil… Will Power The Next Generation Of Super-Exclusive Exotic Cars

So when the company published an update earlier this week about the as-of-yet unveiled model, another nail in the coffin of the internal combustion culture was driven home.

The new unnamed Ferrari is said to start at $535,000, with upgraded options and trim levels expected to add another 15-20%.

This will put the new model just underneath Ferrari’s current flagship supercar, the 800 HP SF90.

We don’t know much else, which is a disappointment to anybody who loves performance figures, but I think you should expect to be surprised.

EV makers Lucid, Tesla and longtime Ferrari rival, Porsche, all have production models capable of achieving the holy-grail of acceleration stats: 0-60 in 2.0 seconds.

What Ferrari will do for 2x the price of any of the above mentioned, will have to remain the stuff of speculation for now.

If you want to talk certainties, however, there is one: The the lithium industry that can expect years of resurgence based on just the EV trend alone.

Lithium Stocks Have Never Been Better Positioned

I know this may seem like a bold statement in light of recent stagnation in monthly sales, but massive socio-economic shifts of this nature do not happen linearly.

There are moments of manic bullishness, and moments of hesitation, which can lead to panic sell-offs.

We witnessed precisely that last year when the lithium bubble popped, sending prices down 75% across the global markets.

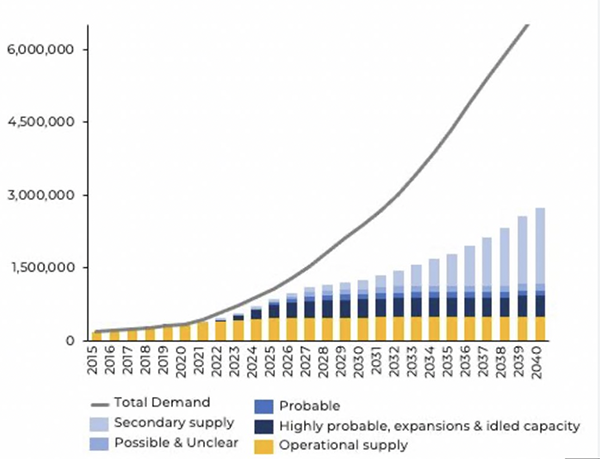

Nevertheless, on a timeline stretching out towards the middle of the century, lithium is destined to become our #1 element for storing energy across several crucial segments.

Electric vehicles, wireless devices, and utility grade energy storage for renewable power production all depend on lithium — and demand for each of these product classes expands every day.

The reason is simple… Lithium delivers the most bang for the buck in terms of energy density.

Pound for pound and dollar for dollar, lithium batteries will make your car, your phone, or your solar farm run longer than anything else.

Post Lithium Bubble Hesitation Is Your Best Friend

Which is why we use it for a vast majority of our energy storage needs.

Ferrari’s decision, albeit purely symbolic considering the sheer mass of the world’s automotive market, is nothing more than the most recent and clearest signal that the future of driving, even for the enthusiasts, will be powered by electrons.

And with the recent lithium bubble burst, now is the time to start buying pieces of this sector.

I prefer a spectrum of lithium stocks from the small to medium, to provide a perfect balance of risk and security.

Here are the two stories I’m following:

A Trillion Dollar Lithium Stock? This May Be The First

Last summer, geologists made the biggest lithium discovery ever on the Oregon/Nevada border.

It’s located within a unique geological structure — remnants from an ancient eruption of the Yellowstone supervolcano that took place 11 million years ago.

The resource locked within this massive caldera is as much as 6 times larger than the next biggest known deposit in the world, and could shift the balance of the global lithium market away from the Chinese for the first time ever.

The company that’s about to start developing the property just recently received a massive loan from the Federal Government to execute its plans.

Like most lithium stocks, it’s depressed right now, but the longterm potential here could be orders of magnitude higher than where it’s currently trading.

Want the rest of the story? Here it is.

This Lithium Technology Allows Turn-Key Diversification into Lithium Production For Oil and Gas Companies

The second story is a microcap lithium play that’s perfected a revolutionary filtration process which can pull high-quality lithium directly from the most unlikely of sources — oilfield brine.

They do it better and cheaper than anybody else in the business, and while investors may not have noticed, the petrochemical and lithium battery industries definitely have.

There’s also already a pilot plant in operation that’s ready to be scaled.

Don’t think of this as a mining play, because that’s not what it is. This is lithium production technology that’s powerful enough to turn almost any oil and gas operation into a lithium producer in weeks, and with no disruption to the regular course of business.

Few know about it, but in the coming 12-18 months, that’s going to change because major collaborations are already in the works.

This one is high risk, but the reward, if successful, will far outweigh any uncertainties.

Check out my full presentation on this lithium technology company, right here. Fortune favors the bold, Alex Koyfman His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.